iFirma Review: How Good Is It For Polish Company Accounting And CRM?

- ifirma - 149zl/month full accounting solution

- Using the Polish accounting CRM interface

- Uploading accounting documents: proof of expenses

- Generating invoices and entering clients payments

- Interactions with the personal accountant

- Monthly statements with Personal Income Tax, VAT and Social Security

- Regular communications from personal Polish accountant

- In conclusion: is iFirma the best Polish accounting firm?

- Frequently Asked Questions

ifirma is an online accounting service for Polish companies that includes a dedicated accountant, and a CRM system to manage your whole company, should it be a personal company for self-employed businesses, or a Limited Liability Company, also called sp z.o.o in Poland.

ifirma - 149zl/month full accounting solution

With an entry price of 149 PLN per month for the basic subscription, on which VAT will be added, some extra costs for specific operations from the accountant (such as getting a dedicated English speaking accountant) or based on a large number of documents to manage, makes it an accessible accounting solution for most companies in Poland, from personal companies to Limited Liability Companies.

Working with them is all straightforward, and beyong the skilled personal accountant that will be working for you, another big plus of using their services is getting access to an easy to use and very complete CRM interface to manage your whole company.

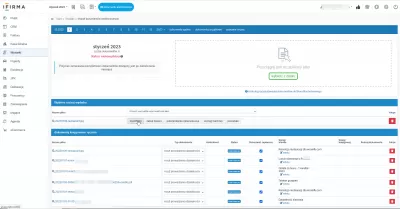

Using the Polish accounting CRM interface

The interface offered by iFirma service is pretty simple, and does not require you to speak Polish, as it can easily be translated in your web browsers.

It allows to manage all possible aspects of a company, from clients management to employees payment - however, the later are mostly relevant for large companies.

Therefore, let's have a deeper look at two aspects that all business registered in Poland will have to deal with, regardless of their activity: registering company expenses, and creating invoices.

Uploading accounting documents: proof of expenses

At all time in the interface, a specific button directly links to documents upload. From the main screen, a specific box is even there to allow for convenient drag and drop operations from the operating system explorer.

Once the document has been uploaded to the system, it will automatically be checked against existing documents.

If a similar document in terms of content has already been uploaded, an error message will be displayed. This is very convenient to avoid double entry of the same documents by mistake.

Then, all you have to do is to select the type of document that has been uploaded:

- business cost,

- goods purchase,

- bank statement,

- ZUS (social security),

- other documents.

Once the type of document has been selected, you may have to perform other operations, such as selecting if the client invoice for business costs has already been paid or not, and, for all documents, it is recommended to add a comment to explain to the accountant what is the purpose of the document - for example, is it a business development expenses or a recruitment related one.

And that's all ! The interfact for documents upload is very easy to understand.

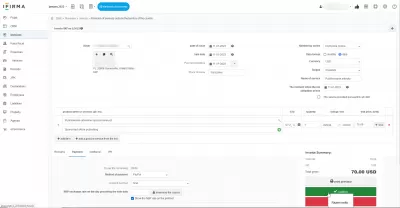

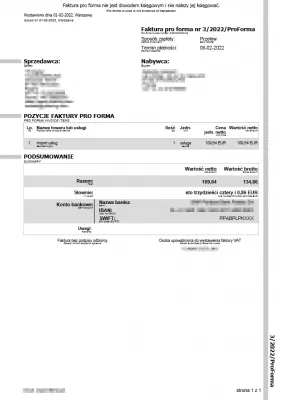

Generating invoices and entering clients payments

Similarly, the invoice generation interface is very simple, and only takes a few steps to be mastered - most of these steps can actually be avoided for the second invoice and beyond, as all you have to do is to create a duplicate of a previously generated invoice and update clients and / or costs for similar services:

- Select the type of invoice (Polish national invoice, VAT invoice, extra-EU invoice, ...),

- Enter a new client in the CRM, or simply pick it up from the clients list if already created,

- Enter the type of goods or services sold, their description, category, price per unit, unit,

- Enter other various information such as creation date, payment date, payment type, eventual currency exchange rate,

- Generate a PDF draft, or save the invoice!

Depending on the payment type chosen, the invoice can even be generated including a QR code for simple payment with another Polish business bank account or a personal one depending on who the recipient is.

The invoices generated are EU VAT compliant invoices and can be sent out to any client anywhere in the world to request a goods or services payment.

Again a simple, fast and efficient process that can fit most professional use cases!

Interactions with the personal accountant

Once your corporate payments and income will have been entered in the system, or even without in some cases, you will regularly hear from your personal dedicated Polish accountant, that will let you know of other necessary business steps.

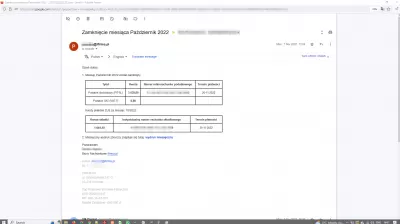

Monthly statements with Personal Income Tax, VAT and Social Security

First of all, every month, you will get from your accountant a summary of the actions you must perform regarding government.

Each month, you'll have to mark your accounting as done from your side, and after that, your accountant calculate how much taxes you have to pay, which might differ depending on your business setup, and might contain but not limited to:

- PIT (Personal Income Tax),

- VAT (Value Added Tax),

- ZUS (Social Security).

For each tax category, your accountant will include the exact bank account towards which the paymnet must be made, giving you the simple task to copy paste bank account number and amount to be paid in your own corporate banking system, and that's it!

Managing your corporate monthly government fees cannot be more simple than that.

Regular communications from personal Polish accountant

On top of that, depending on the regulation changes or some specific events over the year, your accountant will send you various information far before the deadline, to give you enough time to perform an eventual change on your corporate setup.

While the emails are in Polish, they can all easily be translated using your email client built-in translation system, or the one in your browser.

In any case, these emails will often be very complete, and contain links to blog articles or ebooks that explain in details the implications of each specific change.

While legally your accountant cannot give you advice regarding your corporate setup, they will give you all the basic information you need to be able to make the decision yourself, or help you understand where you need to seek advice to potentially find a better setup for your business.

In conclusion: is iFirma the best Polish accounting firm?

In summary, iFirma is complete and yet simple company management interface, that includes a personal dedicated skilled accountant and a full CRM system to manage your whole company as best as possible, avoid any issue, meet all the necessary deadlines, and help your business growth!

Frequently Asked Questions

- How does IFIRMA's CRM and accounting platform stand out in catering to Polish business needs?

- IFIRMA’s platform is tailored for Polish businesses, offering features aligned with local accounting standards and CRM functionalities suited for the regional market.

Yoann Bierling is a Web Publishing & Digital Consulting professional, making a global impact through expertise and innovation in technologies. Passionate about empowering individuals and organizations to thrive in the digital age, he is driven to deliver exceptional results and drive growth through educational content creation.